Business Needs Assessment Survey Results

If you have not done so already, click here to take the survey.

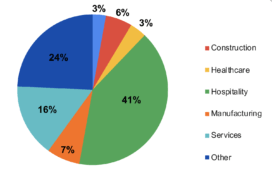

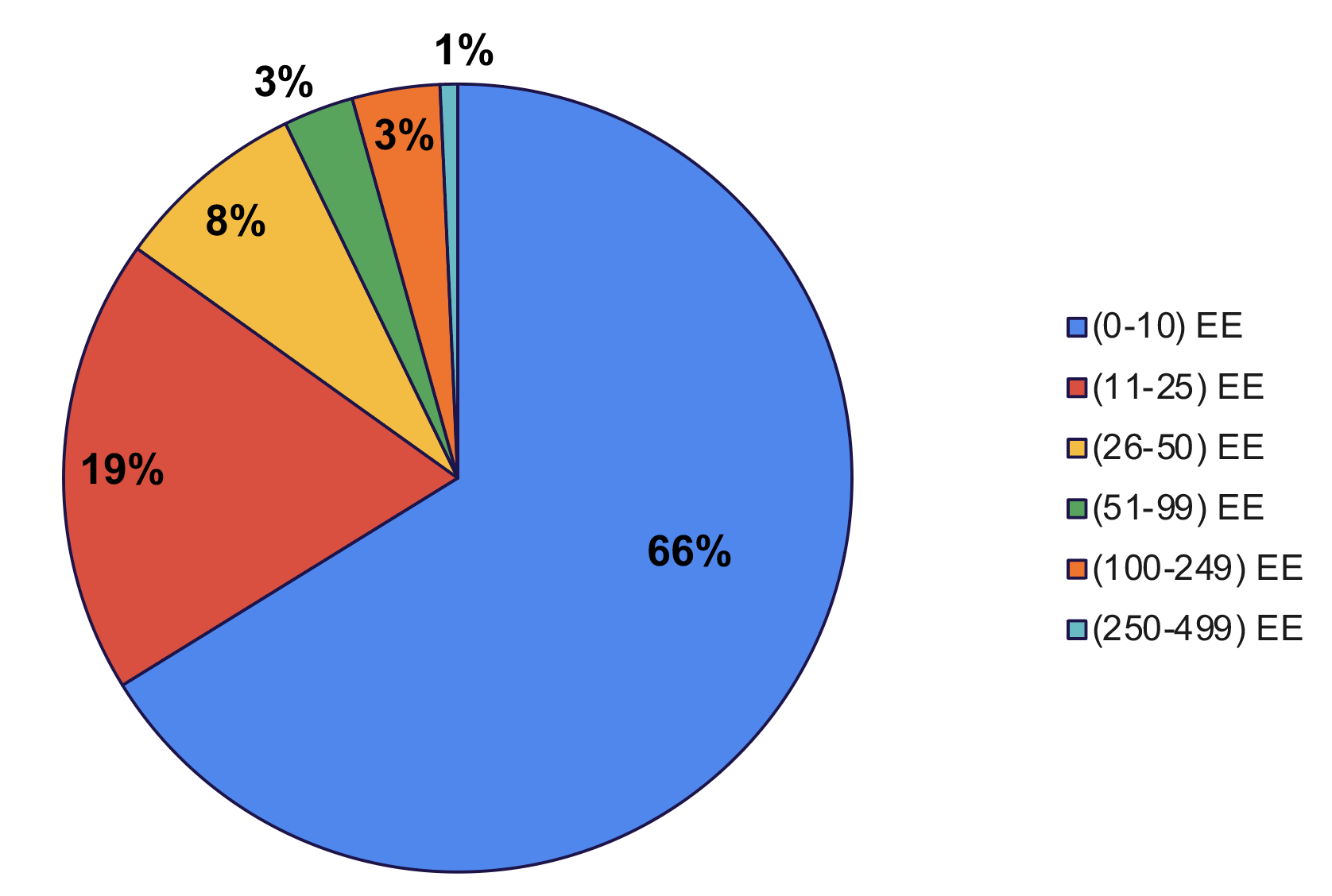

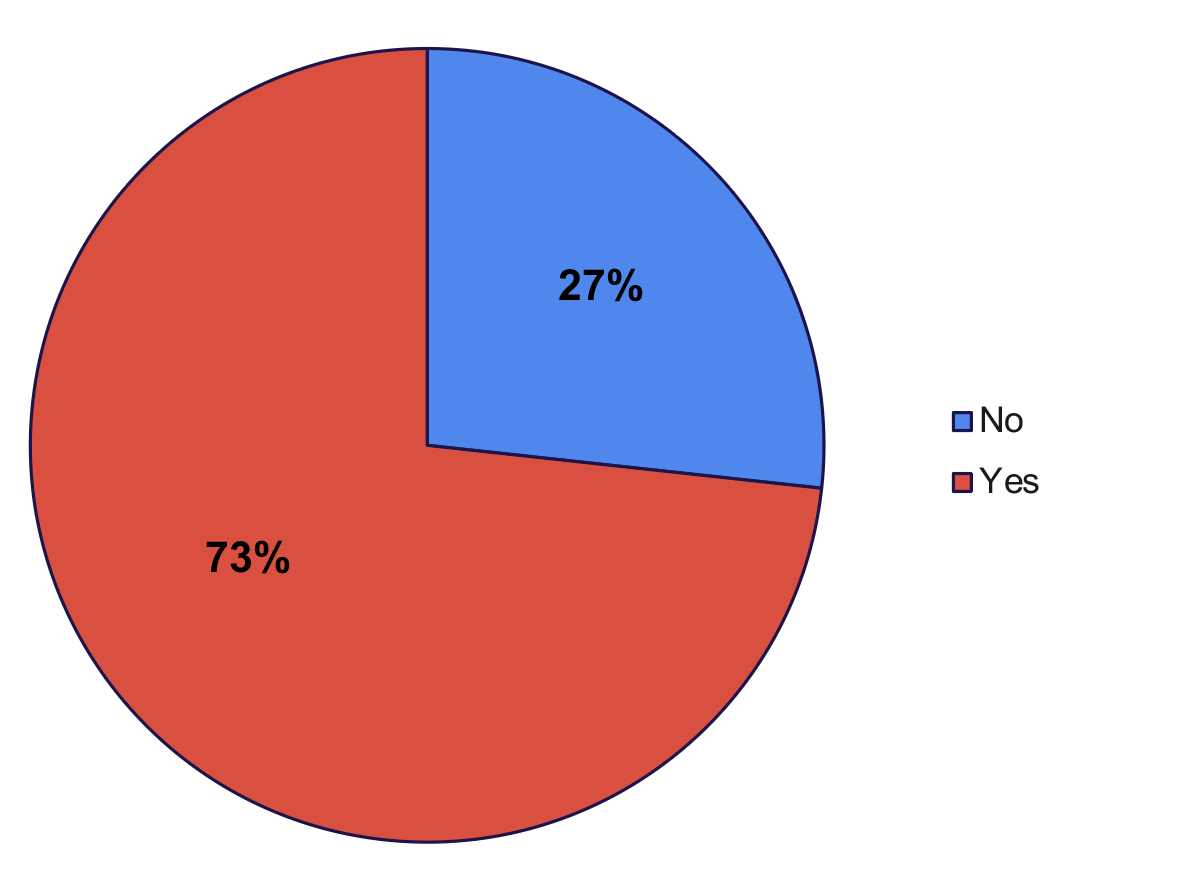

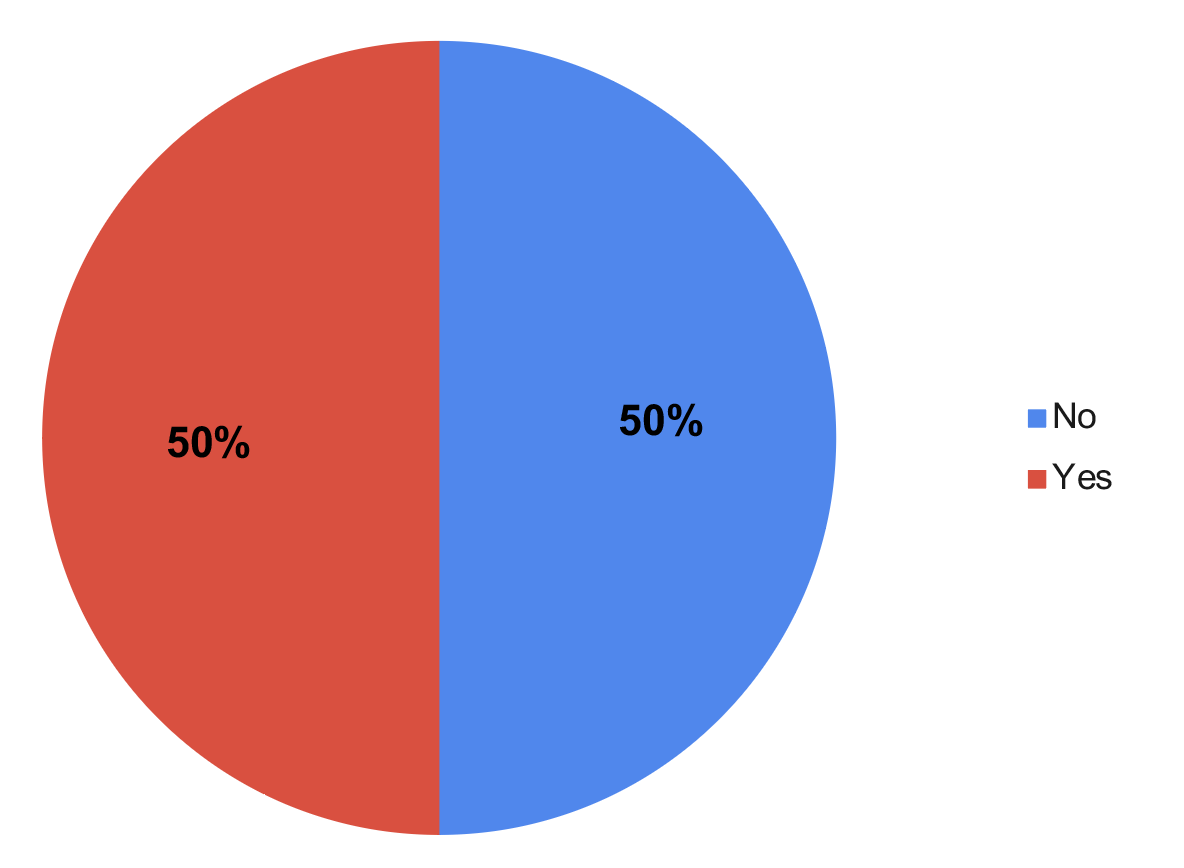

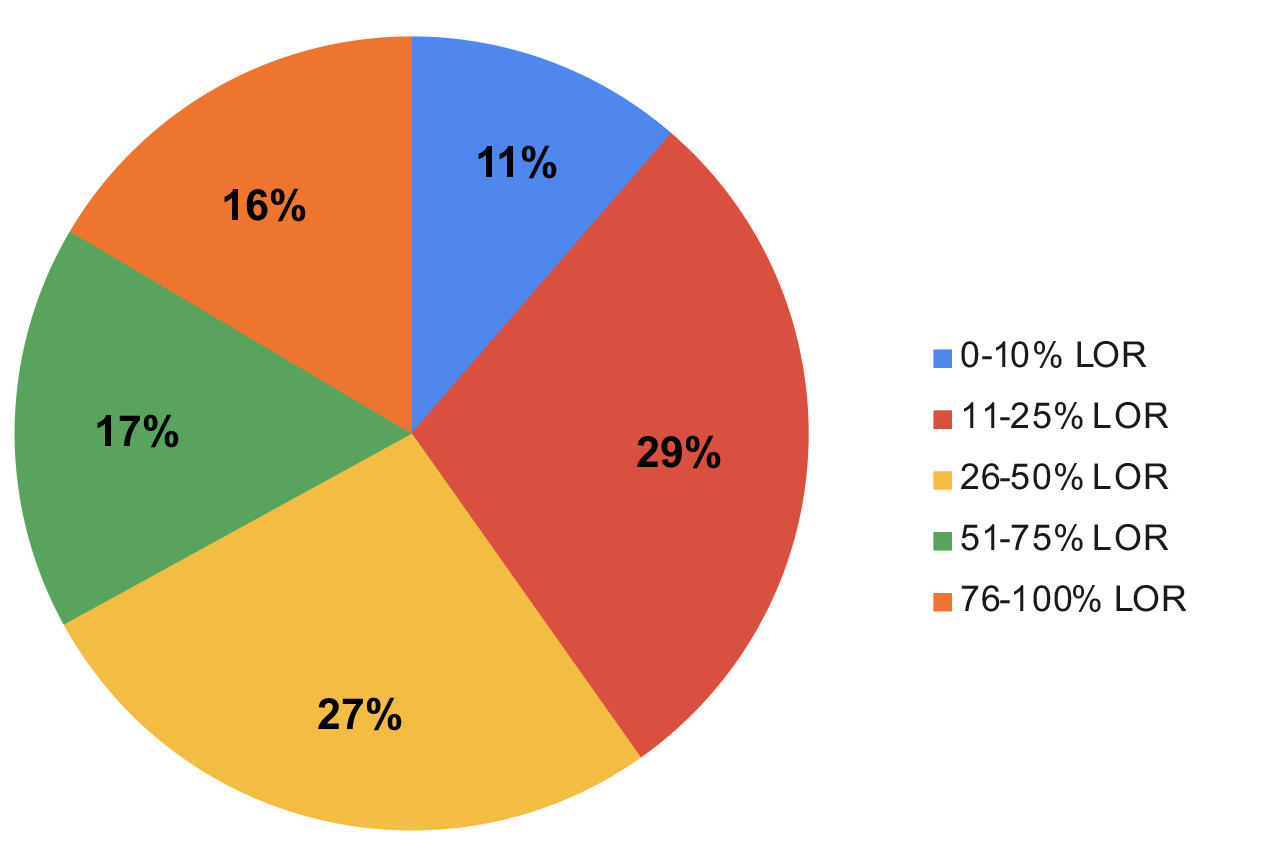

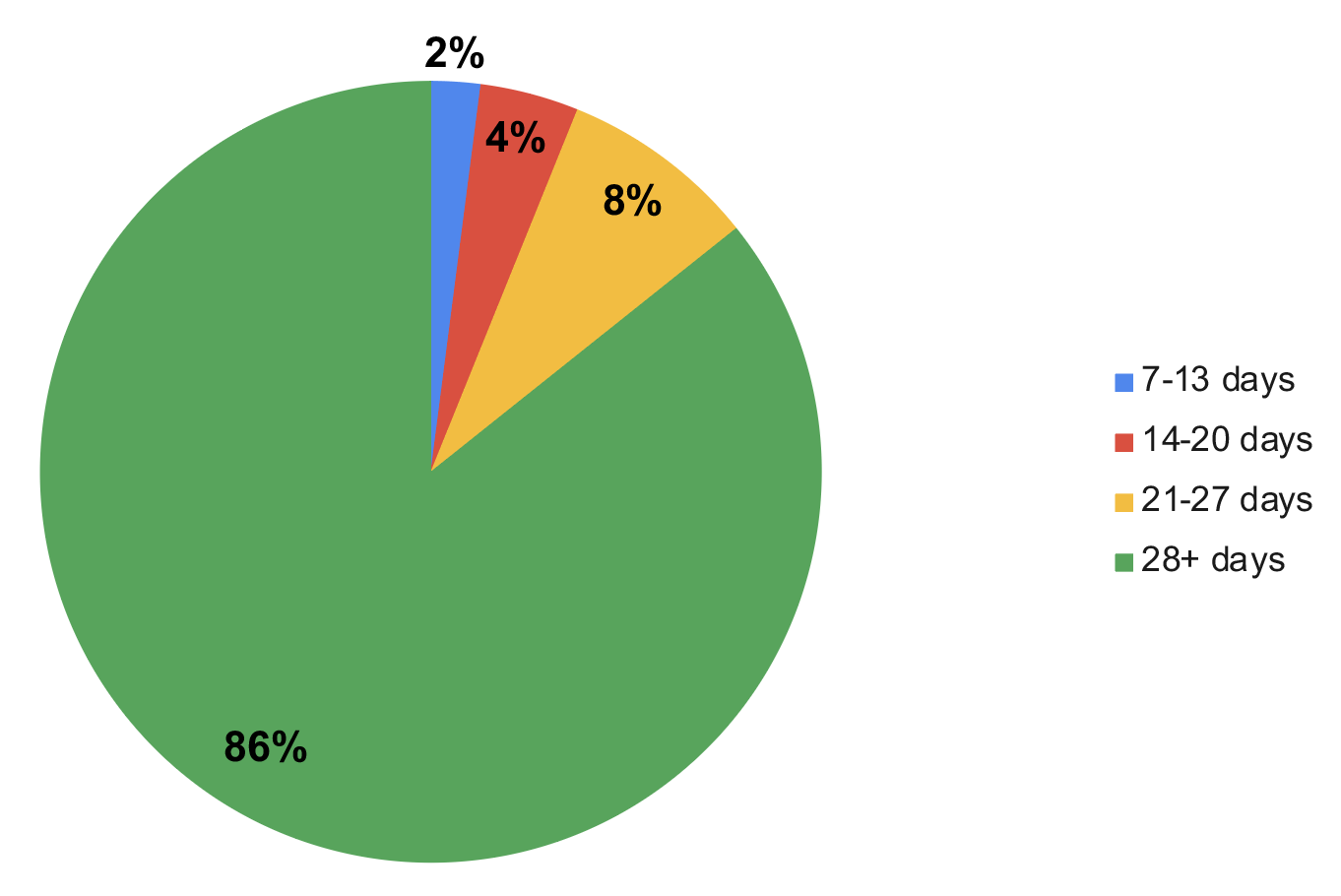

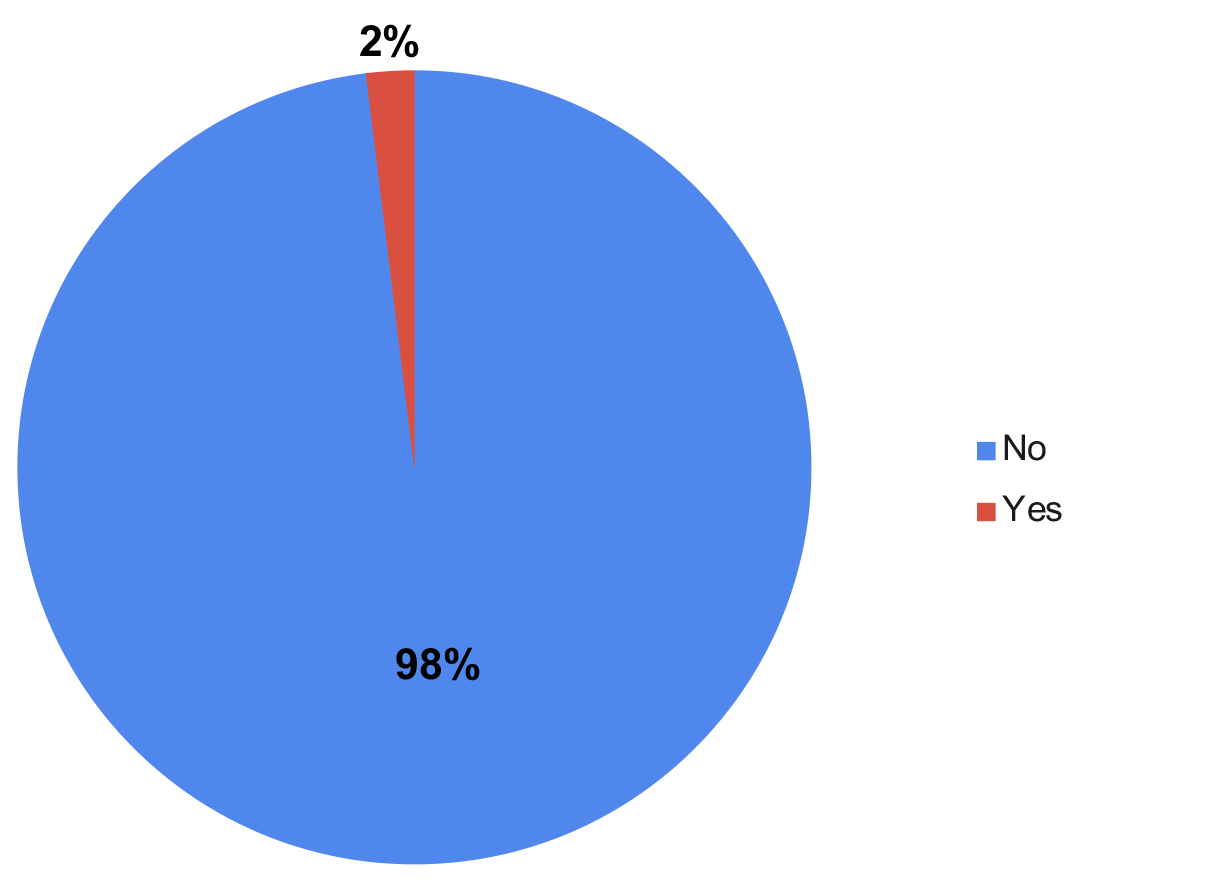

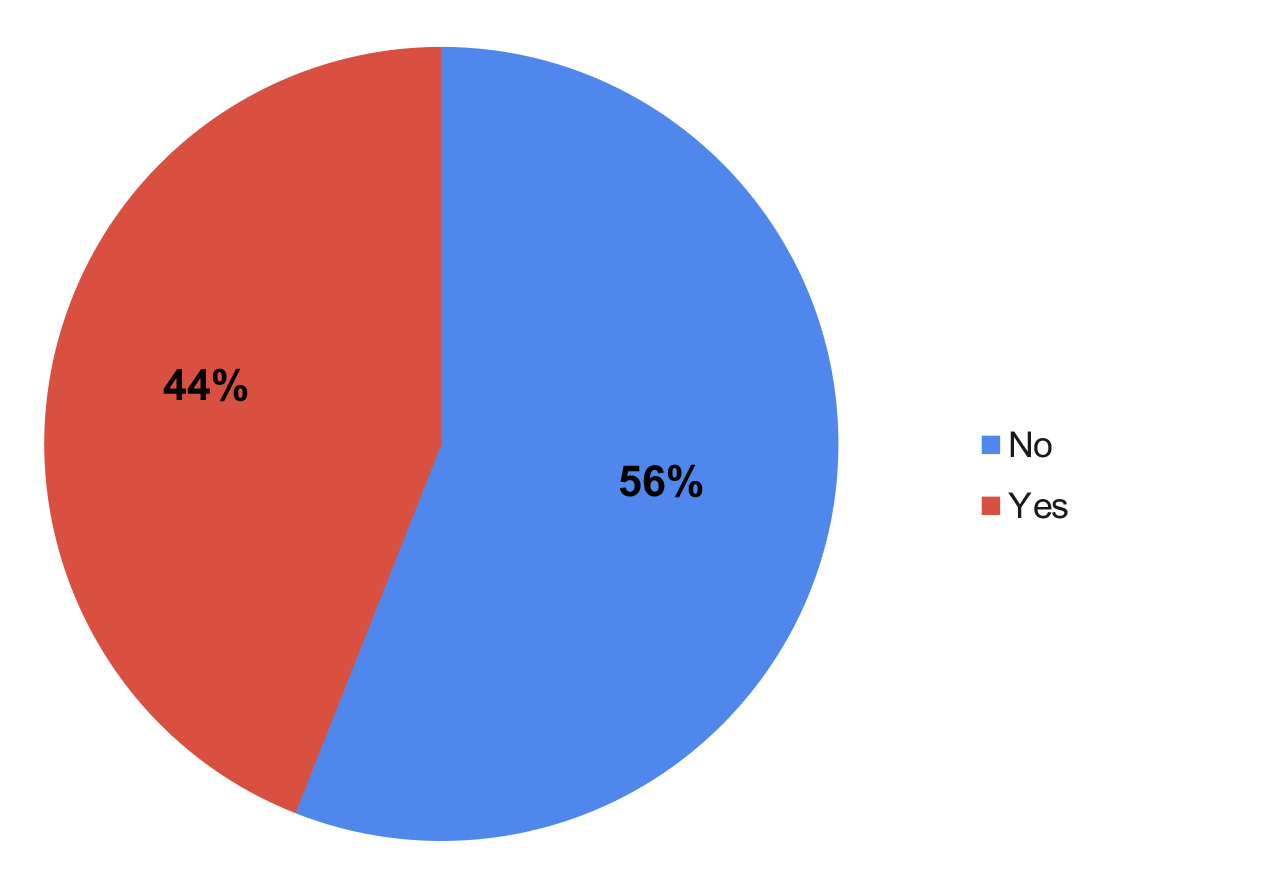

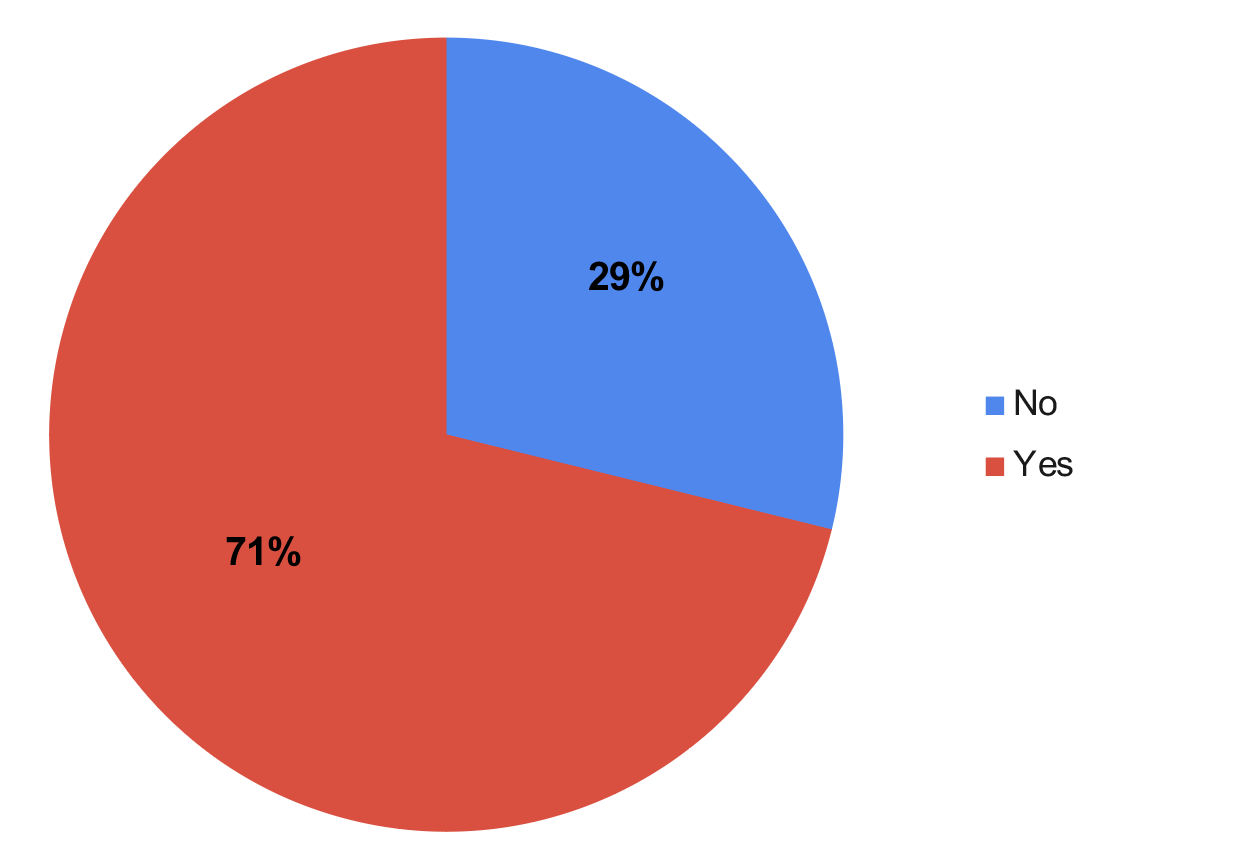

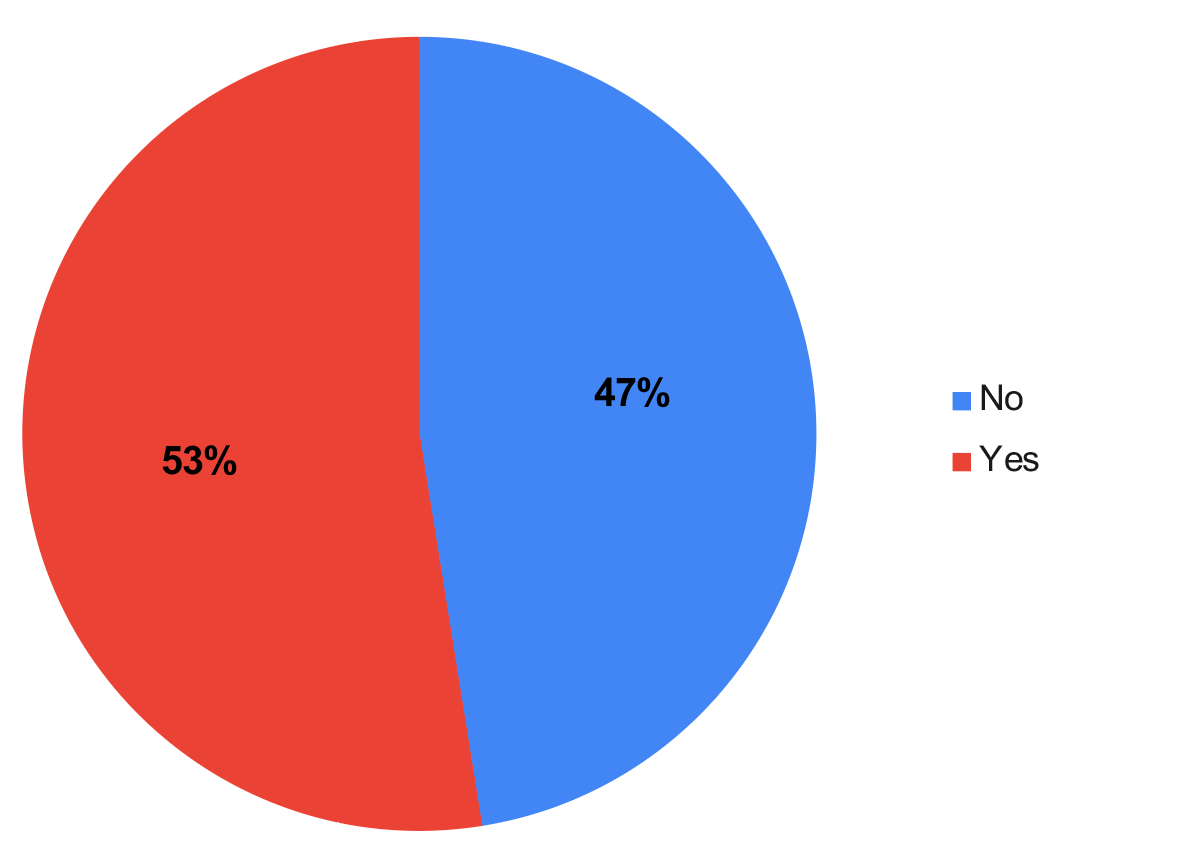

Thank you for completing the 2020 COVID-19 Business Needs Assessment for Walworth County! The following charts are a snapshot of the highlights of the survey that reflect 150 respondents in various industries. This effort was a collaboration between WCEDA and our partners. Below the charts you will find resources that correspond to the survey. Please reference a recent follow-up email for the suggested resources you may want to review below.

Resources

Based on your answers to the survey, we have sent you suggestions for resources you may want to review. Please refer to your individual email for more information. You may also follow up with your local contacts (listed below) who can potentially help you further.

Financial Assistance

0. Contact your bank.

If your bank can’t help, contact one of the partners listed in the contacts section below.

1. Paycheck Protection Program (PPP)

Designed to help retain or rehire employees

2. Economic Injury Disaster Loan

Low-interest loan for working capital with $10k advance option

3. SB 2020 Grant

Have you had a loan with any of the CDFIs on this list? If so, you may be eligible for this grant.

We’re all in Grant

Funded by the federal Coronavirus Aid, Relief and Economic Security (CARES) Act, the We’re All In Small Business Grant Program will provide $2,500 to 30,000 Wisconsin small businesses to assist with the costs of business interruption or for health and safety improvements, wages and salaries, rent, mortgages and inventory.

4. WWBIC Loans

Alternative funding resources with fast-track loans and lines of credit, plus a PPP option

5. KIVA Loans

Crowd-funding, no-interest loans

6. SBA Express Bridge Loan

Option through bank that has forgivable portion

7. Federal and State Tax Deferments

Helps preserve cash.

8. Employee Retention Tax Credit

9. Unemployment for Self-Employed and Independent Contractors

Operations During Crisis

10. Covid-19 Workplace Updates on Resources

Scroll down for resources on guides, sample letters and policies.

11. Work-Share Program

Employer reduces hours and employees receive partial unemployment compensation.

12. Work Exchange Program

Employers essentially loan employees to another company for a specified period of time.

13. Contagious Diseases and Pandemic Toolkit

14. Confirmed Positive COVID-19 Test

10 Steps for Employers.

15. Workplace Tips for Employees

16. Coronavirus Communication Toolkit

Make sure you have a COVID-19 statement on your website and Google profile.

Recovery Plan

18. Free Planning assistance – SBDC, SCORE, WCEDA, WWBIC, your local chamber or visitors bureau

19. Smart Re-start Plan and Worksafe Best Practices from MMAC

20. Back to Work Guides

• Guide from EU

• Guide from Quad Graphics

• Tourism

• Customizable Flyer

• Cleaning and Disinfecting Your Facility – CDC

• OSHA

21. Return to Office Kits –

• Covid-19 Response Signage, Yunker Industries

• Coakley Brothers Interiors Video Clip

22. Training and Business Assistance

• Gateway Workforce Solutions (orientation, safety practices, supervisory, etc.)

rauthj@gtc.edu

• UW-Whitewater business resources (cyber security, economic data, sales, tax assistance, etc.)

kaufmank@uww.edu

23. Workforce Resources – Job Fairs, WCEDA, Job Center of Wisconsin, local staffing firms

24. Marketing Resources – Kreative Solutions, Signalfire, Profound Strategy

25. State guidelines for reopening

wedc.org/reopen-guidelines

Contacts

Led by the Walworth County Economic Development Alliance in cooperation with the following chambers.

Geneva Lake West Chamber, Meg Thompson

chamber@genevalakewest.com

Delavan-Delavan Lake Area Chamber, Sara Sekeres

delavanchamber@sbcglobal.net

Discover Whitewater, Lisa Dawsey

info@whitewaterchamber.com

East Troy Area Chamber, Vanessa Lenz

vanessa@easttroy.org

Elkhorn Area Chamber and Visitors Bureau, Chris Clapper

chris@elkhornchamber.com

Visit Lake Geneva, Stephanie Klett

stephanie@visitlakegeneva.com

Walworth County Economic Development Alliance, Derek D’Auria

derek@walworthbusiness.com

Walworth County Visitors Bureau, Kathy Seeberg

kathy@visitwalworthcounty.com